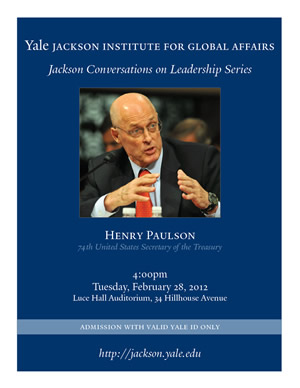

Former Treasury Secretary and Goldman Sachs CEO Henry “Hank” Paulson sat down with General Stanley McChrystal (Ret.) on February 28 for a conversation about leadership sponsored by the Jackson Institute for Global Affairs. Seated in two comfortable chairs at the front of Luce auditorium, McCrystal, a senior fellow at the Institute, began by asking Paulson if leaders are “born or made.” Paulson said he’s always been a very decisive person, with a very expansive definition of leadership, but that “the training that I had before I got to Treasury helped prepare me for the challenges” of that job. “I believe that life experience and training is very important in leadership.”

Paulson spent time working in the Pentagon and the White House during the Nixon administration. Comparing government service with business, he said, “It’s the same skill set but a different mind set.” He said government work is “not leading by fiat; you can have the best idea but unless you can persuade others to adopt it, it’s basically a worthless idea.” He added that the best people in business don’t lead by fiat either, but that it’s much more difficult to get things done in government.

Asked about the transition from government to the private sector, Paulson said, “I thought government was a great experience for the private sector, because you learn how to multitask; you learn you’re not going to be successful unless you can communicate; you learn a lot about working with others.”

McChrystal asked Paulson how he perceived the political landscape when he took over at Treasury in 2006. “I was worried about what I could do, working with a president who had 28 percent approval ratings at that time. I knew enough about government to wonder whether I could be successful,” but resisted giving in to fear of failure. He found that he could do a lot of things. “My approach was to run 100 miles an hour.”

Paulson said he underestimated the extent of the financial crisis “every step of the way until we got the TARP [Troubled Asset Relief Program] authority.”

As to walking the line between being decisive and being cautious, McChrystal asked, “What’s the balance there, particularly when a situation is unclear?”

“When you’re managing in a crisis, if you wait to get all the information, you’ll be looking in the rear view mirror and it’ll be too late. The timing is, you always have to trade off acting without sufficient information and without a perfect solution against the cost of inaction. There was never a situation where I was debating, ‘How much longer should I wait?’ You have to be prepared to act, then if the facts change or your understanding changes, you’ve got to be prepared to change. I did a number of things I think were very objectionable, but they’re easy to do because they’re better than the alternative.”

He said he believed the financial team in place at the end of Bush’s term “got the big things right.” He said his biggest failings were mistakes of communication. “I sent out a three-page outline on TARP at midnight. That got received as being arrogant: take it or leave it. That was supposed to be a starting point for a discussion; it wasn’t definitively what we needed.”